[ad_1]

The power of the US greenback in opposition to Asian currencies is shocking to many and a fear to a number of central banks caught between expectations of restricted motion in opposition to the almighty greenback and the unfavorable affect on their economies of elevating rates of interest to maintain a agency foreign money. Indonesia is struggling to maintain the rupiah beneath 16,000 to the US greenback and the Thai baht is again to 36.5 to the greenback, 5 p.c down on its finish 2023 stage.

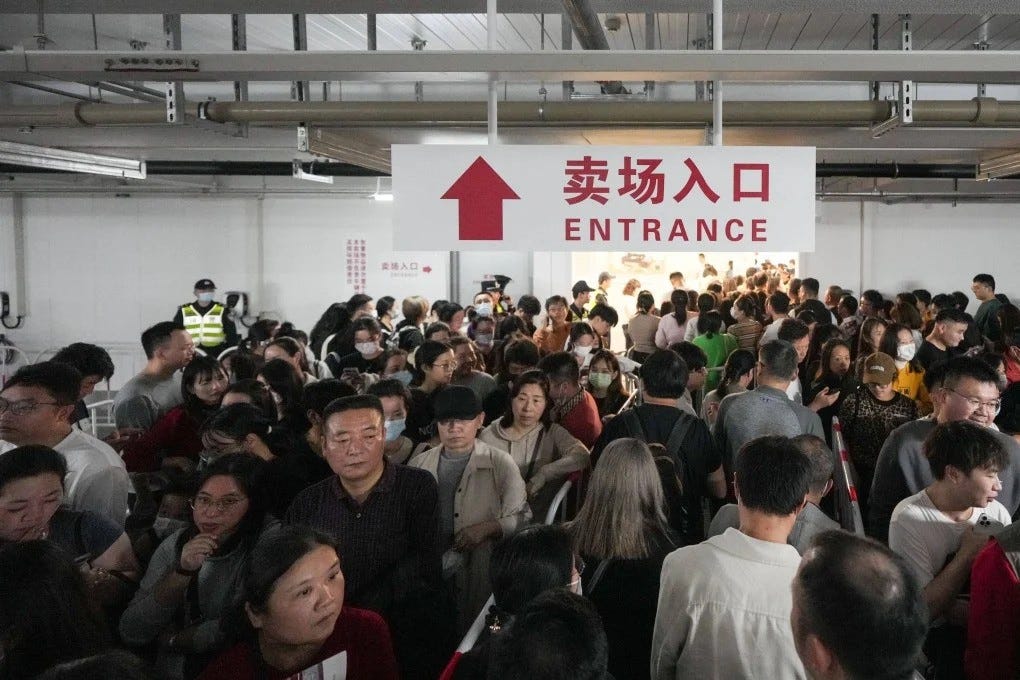

However for the long run, one foreign money particularly stands out not for a right away menace to weakening however whether or not it’s appropriate with different financial developments: the Hong Kong greenback, for many years since its disaster in 1983 pegged to the US greenback. Between March 29 and April 4, Hong Kong had 5 days of vacation – an extended Easter weekend adopted after simply two days by the Ching Ming pageant on April 4. Add within the following weekend there was an extended stretch giving alternative to journey. Big numbers did so, significantly to the mainland which is so shut – just a few minutes on the practice.

The losers had been the Hong Kong companies, eating places particularly, which in any other case would have loved spending by the native inhabitants. Because it was, there was scant counterflow into Hong Kong. There was no equal Easter vacation on the mainland and anyway, though mainland visits to the SAR have picked up, town’s attraction nonetheless lags nicely behind pre-Covid occasions. In the meantime, two different issues have been occurring.

First is the continued enchancment within the rail and bus networks which implies that it has develop into faster to cross the border. For the growing variety of individuals dwelling within the northern New Territories cities reminiscent of Fanling, town on the opposite facet, Shenzhen, is just a few minutes plus a border crossing away. In the meantime, the high-speed rail affords fast entry to locations additional inland. The bridge to Macau and Zhuhai affords one more different.

Hong Kong’s complete value construction is excessive relative to the mainland, with property costs the primary wrongdoer, flowing by means of to wages and all rents. The alternate price has been an added burden. None of that mattered a lot previously. It does now.

Hong Kong individuals might be fed up with listening to authorities officers proclaiming the significance of town integrating into the so-called Higher Bay Space, a current creation which mixes it with a number of cities, together with Guangzhou, in and across the Pearl River Delta. However in terms of spending hard-earned cash, why not spend slightly crossing the border and getting a meal, therapeutic massage, or nearly another service and plenty of items for 30 to 50 p.c lower than in Hong Kong?

The worth hole has at all times been there however requirements in Shenzhen are stated to have improved comparatively, and the worth hole has even been widened by the power of the HK greenback, up 6 p.c in opposition to the RMB in contrast with a 12 months in the past and 10 p.c in contrast with April 2022.

Whereas the mainland has pretty strict alternate controls, there is no such thing as a manner that Hong Kong can undertake it with out ending certainly one of its precept monetary points of interest. Nevertheless, a peg to a detailed proximity to the RMB would make nearer financial integration simpler with the mainland, which is anyway inevitable. Europe has examples of currencies that are unbiased of the euro however typically transfer in keeping with it.

Change aside from in a disaster is just not one thing which comes simply to authorities, particularly in Hong Kong. Anyway, the drawbacks of being pegged to a robust US greenback is probably not round for lengthy. The US greenback attracts inflows solely on account of comparatively excessive rates of interest. Its fundamentals are slightly much less apparent. At about ¥152 to the greenback, the yen is at a 34-year low. But confidence within the greenback contrasts with a file gold value – previously robust gold has mirrored a weak US greenback. It might now mirror common unease concerning the state of the world, so the greenback is seen as the following most suitable choice. However given the prospect of a Trump presidency and likewise the probability of a recession within the US inside a 12 months or so. there are doubters, no less than amongst these with longer views than the typical 30-year-old foreign money dealer.

As for fundamentals, the US now has a present account deficit operating at almost 3 p.c of GDP or US$750 billion a 12 months which wants financing at a time when a lot of the Asian economies along with Japan with presently weak currencies have present account surpluses of two+ p.c of GDP. Within the US itself, voices are growing for the necessity of the Federal authorities to rein in its personal deficit, which is operating at about 7 p.c of GDP and complete debt nearing 130 p.c. These are massive numbers by any commonplace and doubtless can’t be sustained and not using a vital fall within the foreign money, no matter rates of interest. In any occasion, the HK greenback peg to it’s a product of a interval of historical past nearing its finish.

[ad_2]

Source link