[ad_1]

And a few authorized specialists fear that if the decide goes out of his solution to punish the previous president with that worst-case situation, it may make it simpler for courts to wipe out firms sooner or later.

“This can be a mainly a demise penalty for a enterprise,” mentioned Columbia College regulation professor Eric Talley. “Is he getting his simply desserts due to the fraud, or as a result of individuals don’t like him?”

A evaluate by Related Press of almost 150 reported instances since New York’s “repeated fraud” statute was handed in 1956 confirmed that just about each earlier time an organization was taken away, victims and losses had been main components.

Clients had misplaced cash or purchased faulty merchandise or by no means acquired providers ordered, leaving them cheated and offended.

What’s extra, companies had been taken over virtually all the time as a final resort to cease a fraud in progress and defend potential victims.

They included a phoney psychologist who bought doubtful remedies, a faux lawyer who bought false claims he may get college students into regulation faculty, and businessmen who marketed monetary recommendation however as an alternative swindled individuals out of their dwelling deeds.

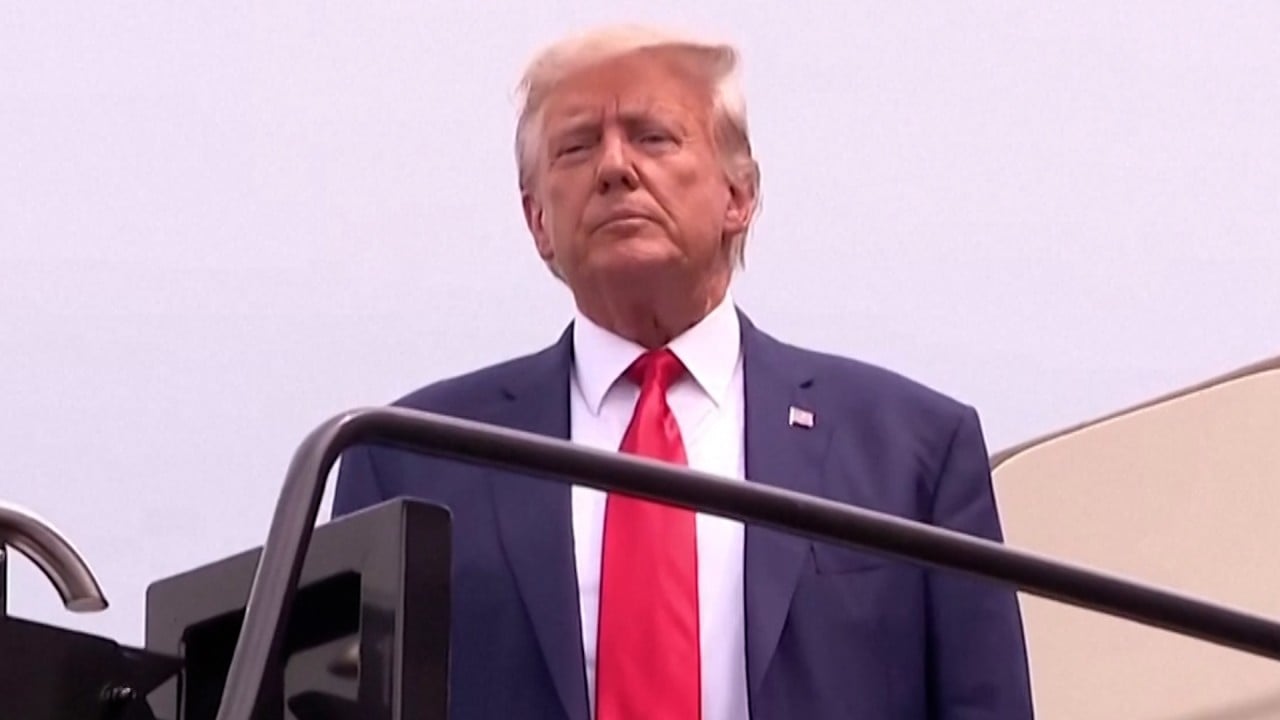

Trump’s money stockpile in danger from US$450 million twin verdicts

Trump’s money stockpile in danger from US$450 million twin verdicts

In Trump’s case, his firm stopped sending exaggerated monetary figures about his internet value to Deutsche Financial institution and others at the very least two years in the past, however a court-appointed monitor famous that was solely after he was sued and that different monetary paperwork continued to comprise errors and misrepresentations.

And though the financial institution supplied Trump decrease rates of interest as a result of he had agreed to personally assure the loans along with his personal cash, it isn’t clear how a lot better the charges had been due to the inflated figures.

The financial institution by no means complained, and it’s unclear how a lot it misplaced, if something. Financial institution officers referred to as to testify couldn’t say for certain if Trump’s private assertion of value had any influence on the charges.

“This units a horrible precedent,” mentioned Adam Leitman Bailey, a New York property lawyer who as soon as efficiently sued a Trump condominium constructing for misrepresenting gross sales to lure consumers.

Trump’s fury over authorized menace

Trump, the Republican presidential entrance runner, has centered his ire at doubtlessly shedding his enterprise at each the Democratic New York legal professional basic who introduced the case and the decide presiding over it.

In an order final September that’s at present below attraction, State Supreme Courtroom Choose Arthur Engoron mentioned Trump had certainly dedicated fraud and will have the state certificates wanted to run a lot of his New York firms revoked.

He mentioned Trump ought to then be stripped of management over these firms, that are the official homeowners of his Fifth Avenue headquarters and different marquee properties, and have them turned over to a receiver who will handle the “dissolution” of them.

What the decide left unclear is what he meant by “dissolution”, whether or not that referred to the liquidation of entities that management properties or the properties themselves. Requested particularly in courtroom whether or not Trump’s buildings could be actually bought as in a chapter, Engoron mentioned he would make clear at a later date.

Trump take a look at may show hardest problem for Taiwan’s subsequent president

Trump take a look at may show hardest problem for Taiwan’s subsequent president

In a worst case, as interpreted by authorized specialists, Engoron may resolve dissolution means stripping Trump of not solely his New York holdings reminiscent of Trump Tower and his 40 Wall Avenue skyscraper, however his Mar-a-Lago membership in Florida, a Chicago lodge and block of flats, and a number of other golf golf equipment, together with ones in Miami, Los Angeles and Scotland.

For her half, New York Legal professional Normal Letitia James has requested that Trump be banned from doing enterprise in New York and pay US$370 million, what she estimates is saved curiosity and different “ill-gotten positive factors”.

However she didn’t ask for a property sale and should not even need one. Stated one in every of her attorneys, Kevin Wallace, in his closing argument: “I don’t assume we’re on the lookout for something that might trigger the liquidation of enterprise.”

Engoron has indicated that throughout the subsequent couple of weeks he’ll difficulty a ruling anticipated to resolve on the money penalty and enterprise ban and make clear his “dissolution” order.

How the anti-fraud regulation is written

Notably, New York’s anti-fraud statute, generally known as Government Regulation 63 (12), is obvious {that a} discovering of fraud doesn’t require intent to deceive or that anybody truly will get duped or loses cash. The legal professional basic should solely present “repeated fraudulent or unlawful acts”.

However the Related Press evaluation, primarily based on a search of reported 63 (12) instances in authorized databases LexisNexis and Westlaw, discovered that victims and losses had been components when it got here to deciding whether or not to take over a enterprise.

A breast most cancers non-profit was shut down 12 years in the past, as an example, for utilizing almost all of its US$9 million in donations to pay for director salaries, perks and different bills, as an alternative of funding free mammograms, analysis and assist for survivors.

A psychological well being facility was closed for looting US$4 million from public funds whereas neglecting sufferers.

There could also be extra dissolved firms than Related Press discovered. Authorized specialists warning that some 63 (12) instances by no means present up in authorized databases as a result of they had been settled, dropped or in any other case not reported.

Trump should pay E. Jean Carroll US$83.3 million in defamation case, jury finds

Trump should pay E. Jean Carroll US$83.3 million in defamation case, jury finds

Nonetheless, the one case Related Press discovered of a enterprise dissolved below the anti-fraud regulation with out citing precise victims or losses was a comparatively small firm closed in 1972 for writing essays for college college students.

In that case, the legal professional basic mentioned the sufferer was “the integrity of the academic course of”.

This isn’t Trump’s first run-in with New York’s anti-fraud regulation. His non-profit Trump Basis agreed to close down in 2018 over allegations he misused funds for political and enterprise pursuits.

And his Trump College was sued below the regulation in 2013 for allegedly deceptive hundreds of scholars with false guarantees of success however it had shut earlier than it may very well be closed by the courts. Trump ultimately settled this and associated instances for US$25 million.

Many years of 63 (12) authorized historical past additionally confirmed many instances the place defendants socked prospects with huge losses and nonetheless obtained to maintain operating their companies.

What lies did Trump inform to get in hassle?

Trump’s case concerned 11 years of economic statements with values primarily based on disputed and typically outright false descriptions of properties used as collateral ought to his loans go bust.

Amongst them: Trump exaggerated the dimensions of his Manhattan penthouse condominium by thrice. He listed unfinished buildings as in the event that they had been full, and flats below hire management as in the event that they had been freed from such guidelines.

He confirmed restricted funds as in the event that they had been liquid money. And Trump valued Mar-a-Lago as a single residence, despite the fact that he had signed away rights to develop it as something however a membership.

In making her case towards Trump, Letitia James referred to as to the stand a lending professional who estimated that Deutsche Financial institution gave up US$168 million in additional curiosity on its Trump loans, basing his calculations as if Trump by no means supplied a private assure.

Hong Kong’s Jimmy Lai informed Apple Each day to not goal Donald Trump, courtroom hears

Hong Kong’s Jimmy Lai informed Apple Each day to not goal Donald Trump, courtroom hears

However Trump did provide a assure, even when his estimate of his private wealth was exaggerated. In reality, the financial institution made its personal estimates of Trump’s private wealth, at instances lopping billions from Trump’s figures, and nonetheless determined to lend to him.

And testimony from Deutsche officers accountable for the loans instructed that deciding the proper price at which to lend, even absent Trump’s private assure, isn’t so easy.

Trump has repeatedly mentioned in impromptu rants at his trial that the case is a meritless, political “witch hunt” as a result of he’s richer than the statements despatched to banks recommend, and lenders didn’t care about these figures anyway as a result of they all the time did their very own evaluation, all the time obtained paid again in full and continued to lend to him.

“What’s occurred right here, sir, is a fraud on me. I’m an harmless man,” Trump mentioned in a six-minute assertion in courtroom earlier this month earlier than the decide lower him off.

Bigger points at play

To make certain, the legal professional basic’s workplace has argued that there are bigger points than sufferer losses at play in Trump’s case.

When huge loans are issued with an inaccurate image of threat, mentioned state lawyer Kevin Wallace, it damages the general public and enterprise neighborhood, “distorts the market” and “costs out trustworthy debtors”.

Plus, Wallace instructed, letting such lies to banks slide if these banks don’t take authorized motion on their very own would quantity to saying, “in case you are wealthy sufficient, you will be allowed to do it.”

Or as New York lawyer and Fordham College adjunct regulation professor Jerry H Goldfeder put it, “Simply because nobody is complaining doesn’t imply there hasn’t been a fraud.”

‘Witch hunt!’ says Trump, on indictment of making an attempt to overturn election outcome

‘Witch hunt!’ says Trump, on indictment of making an attempt to overturn election outcome

In a footnote in a 94-page abstract doc filed earlier this month, Letitia James instructed a compromise choice for Engoron: appoint an impartial monitor to supervise Trump’s operations for 5 years, after which the courtroom may resolve whether or not to revoke his enterprise certificates and probably put him out of enterprise.

College of Michigan’s Thomas says he thinks Engoron could pull again from his shutdown order, however he’s nonetheless involved.

“Those that wish to see Donald Trump undergo by any means needed,” he mentioned, “threat ignoring the very dedication to a rule of regulation that they accuse him of flouting.”

[ad_2]

Source link