[ad_1]

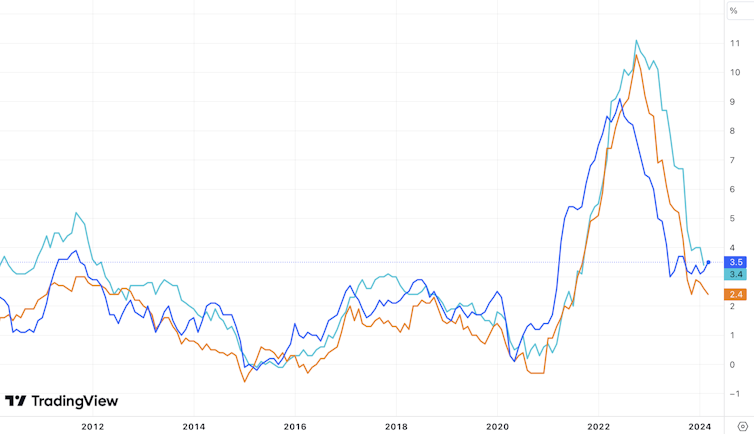

The 0.4% rise in US shopper costs in March didn’t appear to be headline information. It was the identical because the February enhance, and the year-on-year rise of three.5% remains to be sharply down from 5% a yr in the past.

All the identical, this modest uptick in annual inflation from 3.2% in February has forged doubt on whether or not the US central financial institution, the Federal Reserve, can afford to chop headline rates of interest as quick because it has been signalling. To additional complicate issues, a spot has opened up between the US inflation price and that of different areas, notably the EU.

US inflation vs EU and UK

Buying and selling View

Monetary markets’ immediate response was bearish. They dumped shares whereas shopping for EU authorities bonds, in expectation of a lift from the European Central Financial institution reducing its charges sooner. Additionally they purchased the US greenback, anticipating it is going to strengthen when European charges come down. However how is that this more likely to play out?

Can all of them be proper?

The US financial system has returned to regular enlargement after the COVID-19 pandemic disruption of 2020-22, whereas Europe is struggling to realize any development. This helps to clarify the distinction within the inflation figures.

The power of the US financial system was already placing strain on the Fed to chop much less shortly. The next rate of interest helps to cease sturdy demand straining provide chains and making costs rise too quick. The quickening of consumer-price inflation provides the Fed an added incentive to be hawkish on charges – to persuade companies and households that it’s going to maintain financial situations tight till inflation falls again to the two% goal.

The rates of interest on advance purchases of US debt (the “Fed futures” market) present {that a} majority of merchants now anticipate the Fed is not going to drop its rate of interest from the present stage (of 5.25% to five.5%) to under 5% till December. Every week in the past, most thought this could have occurred by September.

The difficulty is that an prolonged interval of upper charges could possibly be very damaging as a result of there’s a lot debt within the system. Specifically, final yr’s wobbles within the US banking sector, and wider issues about institutional buyers uncovered to a stoop in industrial actual property, are sturdy incentives to cut back credit score prices earlier than too lengthy.

Consequently, few consider the US headline rate of interest will nonetheless be at current ranges a yr from now. But the longer that inflation endures, the extra the strain to delay additional price cuts. Most Individuals now consider inflation will keep round 3% for the subsequent yr, an expectation echoed in markets for belongings seen as defending in opposition to inflation (akin to gold and cryptocurrencies).

Election-year inflation risks

An particularly fraught presidential election race additionally limits the Fed’s manoeuvring room. The White Home has pitched its 2024-25 federal funds as serving to to subdue inflation, by reducing working households’ residing prices and forcing firms to pass-on value financial savings.

However whereas Joe Biden goals to spend US$7.3 trillion (£5.8 trillion) in pursuit of his plans, congressional opponents are more likely to block most of the tax will increase supposed to pay for them.

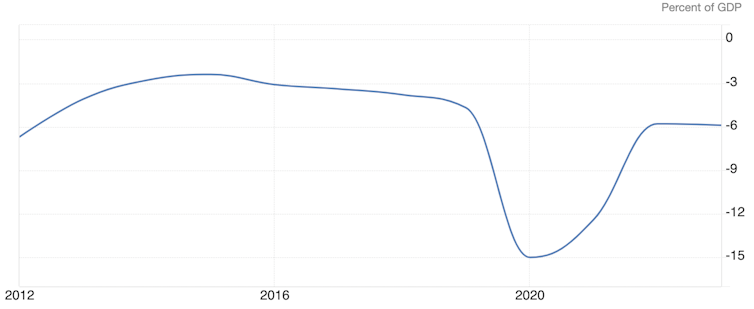

That’s more likely to imply a continued widening of the US federal deficit, injecting extra demand and maintaining inflationary strain. That strain could possibly be worsened by the punitive tariffs that Republicans wish to impose on low cost imports, to which many Democrats are sympathetic. An more and more bipartisan push for tighter border controls would additionally elevate US inflation threat, by stemming the influx of low cost labour that has stored unskilled wages down.

US federal deficit

Buying and selling Economics

The case for reducing anyway

Regardless of these caveats, monetary markets may properly nonetheless be proved improper concerning the velocity of US price cuts. In addition to the private-sector debt issues, one extra potential justification for reducing sooner truly pertains to inflation. Whereas central banks respect the traditional knowledge that increased rates of interest scale back inflation, they can not disregard proof that the impact could also be reversed if charges are stored excessive for too lengthy.

When companies anticipate rates of interest to remain excessive, they elevate costs to compensate, particularly if heavier debt repayments spur workers to ask for extra pay. Notably, the rising value of mortgages within the US was one of many components in March’s inflation shock. The Fed can finest deal with this by sustaining the peace of mind of decrease rates of interest, in order that lodging prices can fall.

In the meantime, China is grappling with falling costs, which might do even worse injury than an inflation overshoot. There’s nonetheless a risk of China making an attempt to flee this example by flooding the world with low cost items, and vitality prices falling sharply when the Russia-Ukraine conflict ends. This would go away central banks in Europe and America involved to cease their inflation falling too far, by reducing charges sooner than the market at the moment expects.

EPA

The Fed should lastly issue within the international draw back of holding agency whereas different central banks’ rates of interest fall. This could deal a double blow to the numerous international locations, and non-US firms, which have borrowed in US {dollars} to finance their enlargement plans. They’d pay comparatively extra on their greenback debt, whereas their native foreign money revenues would purchase fewer {dollars}, because the greenback strengthens as US rates of interest transfer comparatively increased.

The greenback’s international attain signifies that if the Fed doesn’t let headline charges fall, it may exacerbate a world slowdown. That might rebound in opposition to American producers, particularly these now reliant on Europe, Latin America and Asia as main export markets. So when the ECB cuts charges, the Fed may be nonetheless anticipated to comply with, even when it means US inflation remaining above goal into 2025. This might imply one other enhance to inventory costs, recent incentives to borrow extra money, and higher instability for the years forward.

[ad_2]

Source link