[ad_1]

Drewry has printed its keenly awaited first field spot price particulars of the yr, with the Purple Sea delivery disaster sending charges rocketing.

The UK consultancy skipped every week in the course of the festive interval, so right now marks the primary publication of the World Container Index since December 21, a time period that has seen a sizeable swathe of the liner trade ditch the Purple Sea and the Suez Canal for longer journeys across the Cape of Good Hope.

Drewry’s world composite index was up by greater than $1,000 over the previous fortnight to $2,669.91 per feu whereas charges from Shanghai to Rotterdam have greater than doubled, up 115%, to $3,577 per feu.

The Purple Sea disaster noticed the Shanghai Containerized Freight Index (SCFI), one other key spot price information level, rise by 40% final week – solely the fourth time since 2009 that spot freight charges jumped by greater than 40% in a single week.

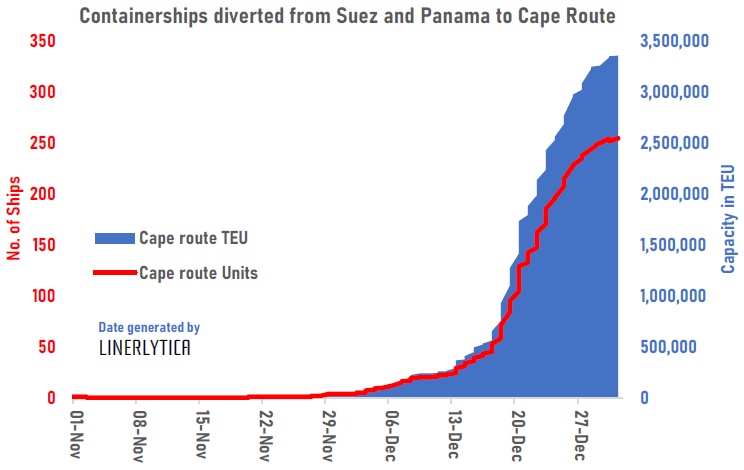

Analysts at Linerlytica, an Asia-based consultancy, count on elevated charges to carry by way of January and February as capability will stay tight within the subsequent six weeks.

“12% of world containership capability is presently diverted to the Cape route and their numbers will proceed to rise,” Linerlytica instructed in a report printed earlier this week.

“Carriers can also be benefitting from firming demand, with Chinese language exports rising for the primary time in six months in November,” rival consultancy Alphaliner identified in its most up-to-date weekly report.

[ad_2]

Source link