[ad_1]

Round 5 million households have seen their mortgage rate of interest change because the Financial institution of England base fee began to rise in late 2021. Over the course of the 2023 alone, the bottom fee elevated from 3.5% to five.25%, surpassing economists’ expectations and pushing mortgage charges to the very best ranges since 2008. For some individuals, repayments have elevated by tons of of kilos in a single day.

Many individuals dealing with elevated month-to-month mortgage funds had been already managing stretched budgets because of the rising price of residing. Inflation for households with mortgages is estimated to be the very best for any socio-economic group.

Some households have chosen to scale back the strain by remortgaging over a long term. Mortgages of 35 years or extra have elevated from round 5% to 12% of the market within the final two years. What’s extra, 28% of recent owner-occupier mortgages had been agreed on phrases longer than 30 years.

Those who wish to get on the property ladder – notably millennials, the oldest of whom at the moment are reaching their mid-30s – are as an alternative being pressured to proceed to hire, at the same time as rents soar by 10.2%. The ensuing drop in demand for homeloans could be seen within the figures for brand new mortgage approvals for residence purchases, which averaged round 47,000 per 30 days in 2023 (as of October), properly under the pre-pandemic common of 65,000 approvals.

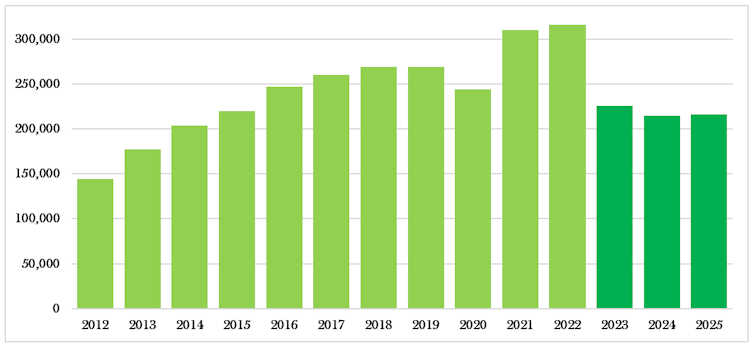

Whole mortgage lending fell by 25% in 2023 and isn’t anticipated to get better in 2024.

Mortgage lending has fallen just lately

Writer supplied utilizing information from UK Finance, CC BY-NC-ND

The place are charges headed in 2024?

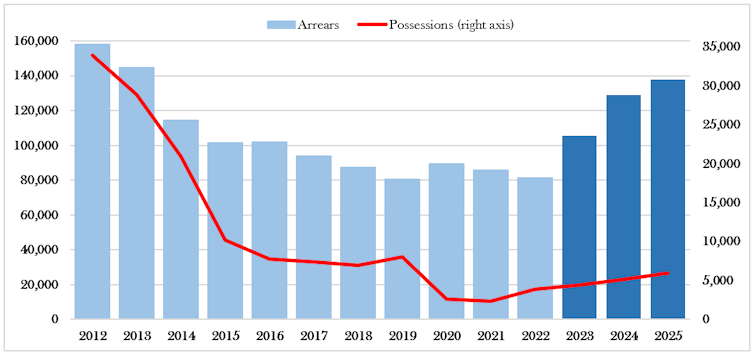

Indicators that households are struggling to maintain up with mortgage funds are getting stronger, with extra individuals now falling into arrears. Though much less extreme than beforehand forecast, trade physique UK Finance expects arrears and possessions to proceed to rise.

Arrears and repossessions are rising

Writer supplied utilizing information from UK Finance, CC BY-NC-ND

And as extra owners come off a budget fastened charges of pre-2022 interval, round 2.3 million households are anticipated to face larger charges in 2024, with a mean month-to-month compensation improve of £240. The Financial institution of England has forecast that round 440,000 households will battle to afford these will increase.

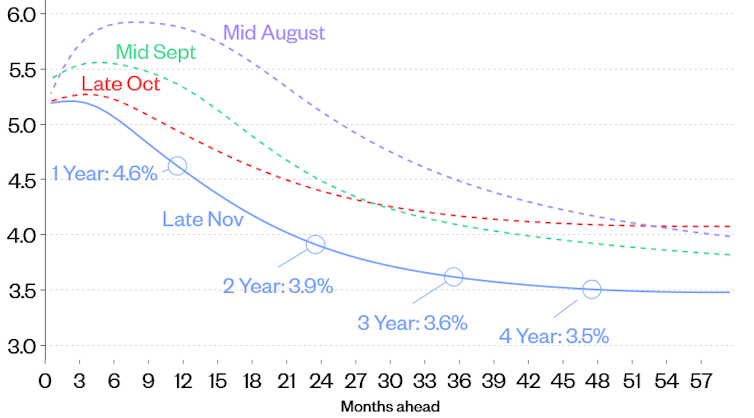

There’s some excellent news: market expectations are for the Financial institution of England base fee to fall. It’s anticipated to ease to round 4.25% by the top of 2026, from 5.25% proper now. So, we might properly have handed the height for rates of interest.

Expectations for the Financial institution of England base fee are altering

Nationwide Home Worth Index, utilizing Financial institution of England information

Mortgage charges (that are typically tied to the bottom fee) have already dropped since September, when the Financial institution of England determined to carry the bottom fee as inflation slowed. In early January, Halifax minimize some charges by almost 0.8% and HSBC additionally introduced reductions for sure merchandise. Mortgage brokers consider this might encourage extra fee cuts by different lenders.

Charges nonetheless stay excessive in comparison with latest years, however this downward pattern will proceed to assist family funds this yr. For the typical £200,000 mortgage, for instance, a 1% drop from 5.8% to 4.8% would result in yearly financial savings of round £2,000.

Nevertheless it’s unrealistic to anticipate the mortgage charges to return to the 325-year lows noticed between 2008 and 2021. Moreover, a 3rd of the Financial Coverage Committee – the group that decides what the Financial institution of England base fee ought to be – are nonetheless eager to extend the bottom fee to fulfill the Financial institution of England’s 2% inflation goal. The present degree of inflation is 4.2%.

So, UK owners might not be out of the woods but. Additional fee cuts will rely on the long run course of inflation, which is troublesome to foretell as a result of it’s influenced by many exterior components – vitality and meals costs could be affected by wars and different world crises.

À lire aussi :

5 methods to scale back your mortgage repayments in 2023 – and why charges have risen so excessive

What to do for those who want a mortgage in 2024

To start out with, contemplate in search of recommendation from a certified, impartial mortgage advisor. They’ll focus on your private circumstances with you. Additionally they might have entry to raised offers than you could find your self on-line or via your financial institution.

In case you are a first-time purchaser, because the Financial institution of England is predicted to carry charges for now, it might be smart to attend for charges to ease a bit extra. Throughout this time, save as a lot as you may in the direction of your deposit. Each will assist to scale back your borrowing prices. Nevertheless, there’s at all times the danger that charges and inflation cease falling or slowing as a result of surprising adjustments within the financial and political atmosphere.

In case your finances is tight and you might be frightened about affording elevated repayments sooner or later, extending your mortgage time period would cut back month-to-month funds. However it should take longer to repay your mortgage consequently. You could possibly make overpayments sooner or later to catch up in case your monetary scenario adjustments, however that is usually restricted to 10% of the stability per yr.

One other various is to briefly change to interest-only repayments for a few years. This implies you aren’t paying off the cash you have got borrowed, simply the curiosity. As soon as the charges are decrease you may change again to a compensation mortgage. However once more, this can lengthen the time it takes to repay your mortgage.

In case you are on a fixed-rate mortgage that’s about to finish in 2024, be certain that to verify your lender’s commonplace variable fee (SVR). That is the speed you’ll mechanically transfer on to if you don’t remortgage. However SVRs are sometimes the very best charges round, so it might be greatest to search for a greater deal earlier than your present fee ends.

If your own home is likely one of the 375,654 properties purchased through the federal government’s help-to-buy mortgage scheme, verify how a lot you’ll be charged for those who proceed along with your present deal. The charges below these schemes could be extra aggressive than regular market charges. Nevertheless, take into account that you’ll share any future capital acquire with the federal government if your own home will increase in worth because the scheme owns a share of it (usually a most of 20%).

Not too long ago, the UK’s mortgage lenders agreed with the federal government on plenty of measures to help individuals combating their mortgage repayments. So, if you’re frightened, it’s greatest to speak to your financial institution prematurely about the way it can assist.

[ad_2]

Source link