[ad_1]

Central banks on either side of the Atlantic stored their primary rates of interest unchanged for the fourth successive month in December 2023. These charges are carefully watched as a result of they set the minimal curiosity at which your financial institution borrows and lends. This determines the price of credit score for all corporations and households with mortgages or different loans.

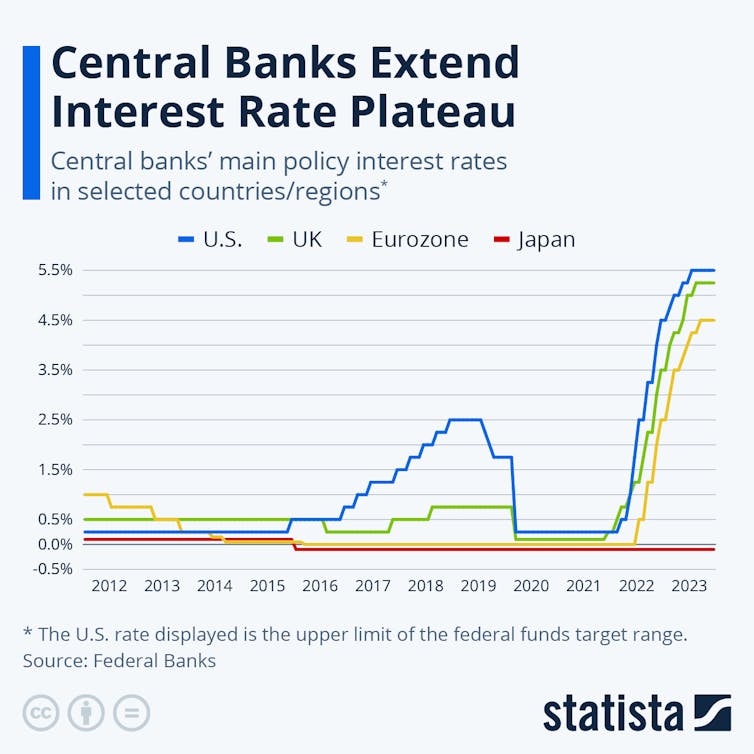

The European Central Financial institution (ECB), the US Federal Reserve and the UK Financial institution of England have raised rates of interest sharply for the reason that begin of 2022. This was in response to a surge in inflation – the annual improve in shopper costs – far above the two% fee that every one these central banks now goal.

However UK inflation is taking longer to reply than that of the US or EU. This has renewed debate over whether or not fee cuts are one of the best or solely strategy to preserve inflation beneath management. It has additionally brought on a shift in opinions about which western economies are most liable to recession in 2024.

À lire aussi :

Is the UK in a recession? How central banks determine and why it is so laborious to name it

Increased rates of interest are designed to subdue inflation by decreasing the quantity individuals spend. Companies and households are anticipated to avoid wasting extra when charges rise, in anticipation of better curiosity funds (though that doesn’t at all times occur). It’s additionally hoped they’ll borrow much less due to the additional curiosity they’d be charged. These with excellent loans are left with much less to spend on items and providers after paying their curiosity invoice.

Governments are additionally affected. Within the UK, curiosity on round 1 / 4 of presidency debt is now linked to inflation. This implies extra of the funds will get channelled into curiosity funds, leaving much less to spend on public providers, when the central financial institution raises charges.

This restraint doesn’t occur instantly, nonetheless. When debtors take out fixed-rate loans, they aren’t affected by larger base charges till the deal expires. Virtually one million UK debtors, for instance, are nonetheless on mounted charges of two% or beneath that may solely come up for renewal – at present, larger charges – within the first quarter of 2024. The ensuing delay of a 12 months or extra earlier than previous rate of interest rises kick in makes it laborious for central bankers to know once they’ve raised charges sufficient to chill the financial system.

À lire aussi :

UK bonds have hit a 25-year excessive – this is what which means for the financial system

Elevating rates of interest may also restrain inflation by encouraging overseas buyers to purchase bonds and different monetary property in a rustic’s forex. The ensuing influx of capital is more likely to strengthen its trade fee. This makes imports cheaper and can assist to gradual the general rise in costs.

A stronger forex is particularly efficient for curbing inflation for economies that eat a excessive proportion of imports, such because the UK. But it surely additionally hurts exporters, and solely works if rates of interest rise above these of comparable economies. This can be one motive why the Financial institution of England has raised its rates of interest sooner and additional than the ECB since February 2022.

Statista, CC BY

Divergence forward

Though they hiked charges in comparable trend in 2022-23, these central banks are set to go other ways in 2024.

US charges are set to fall as inflation drops again in the direction of the two% goal, having already slowed to three.1% in November 2023 (from 6.4% in January). The US Federal Reserve has signalled two seemingly rate of interest reductions, totalling 0.75%, in 2024. That’s falling into line with buyers’ expectations, which may be gauged by the costs they’re ready to pay for buying and selling or swapping debt due at a future date and by rates of interest on authorities bonds that mature a number of years from now.

Whereas the ECB’s ahead steerage is much less clear, its governor has hinted at an identical downward path in 2024 as a result of projections now level to headline inflation dropping to 2.1% in 2025 – a 12 months sooner than beforehand predicted. Eurozone inflation has already slowed sharply, to 2.4% in November from 8.5% in February 2023, regardless of the ECB conserving its rates of interest decrease than the US and UK all through the current tightening part. That’s largely as a result of, though member states set their very own fiscal coverage, EU guidelines preserve them on a decent rein with regards to spending and debt ranges.

In distinction the Financial institution of England has warned that its base fee, already larger than the EU’s, is more likely to keep at 5.25% “for an prolonged time frame”. Inflation (on its focused shopper value index) slowed to 4.6% in October, properly down from its peak above 11% in October 2022, however the common family is braced for extra value of dwelling will increase together with a mid-winter 5% rise within the power value cap. The current weakening of the pound in opposition to the greenback has additionally added to industries’ uncooked materials prices, and will worsen if UK rates of interest fall too quickly.

À lire aussi :

Inflation has affected the UK, US and Europe in a different way – this is what this implies for rates of interest

Recession risk isn’t over

The UK financial system, whereas hardly rising this 12 months, has defied the Financial institution’s earlier forecast of a recession from the top of 2022. However as a result of this inspired the financial institution into one other near-doubling of base charges – from 2.25% in October 2022 to five.25% from August 2023 – a UK recession in 2024 continues to be anticipated by some commentators. Sadly, shopper spending has been much less affected by larger borrowing prices than personal and public funding, which in the end drive financial progress.

Extra ominously for US president Joe Biden, present rate of interest patterns counsel the US may be heading for recession in a presidential election 12 months. Most US GDP forecasts for 2024 stay within the 1.5-2.0% vary, however that’s properly down from the 4.9% reached in third-quarter 2023. Towards this backdrop, the eurozone’s official forecast of 1.2% progress in 2024 might be seen as a comparatively robust efficiency because it’s not anticipated to gradual as a lot because the US is predicted to in 2024.

So, debtors already hit by larger prices can count on some reduction in 2024. However that’s partly attributable to rising concern that, with falling international commodity costs already serving to to subdue inflation, central bankers might have utilized the brakes too laborious since 2022, endangering a worldwide restoration.

[ad_2]

Source link