[ad_1]

At the moment we are going to give a high-level have a look at half considered one of Jonathon Sine’s The Rise and Fall of LGFVs. Sine’s article could be very detailed, but written with a watch to holding reader curiosity. Right here Sine succeeds by going by the historical past of how these autos, which have are the mechanism for blowing China’s actual property bubble so large and creating severe financial/funding distortions.

I hope to restrict how a lot I recap the evolution of the LGFVs and as a substitute give attention to how they’ve created large leverage in these buildings, together with (in lots of instances) a lot complexity that they’d be troublesome to unwind even when somebody have been so daring as to aim that.

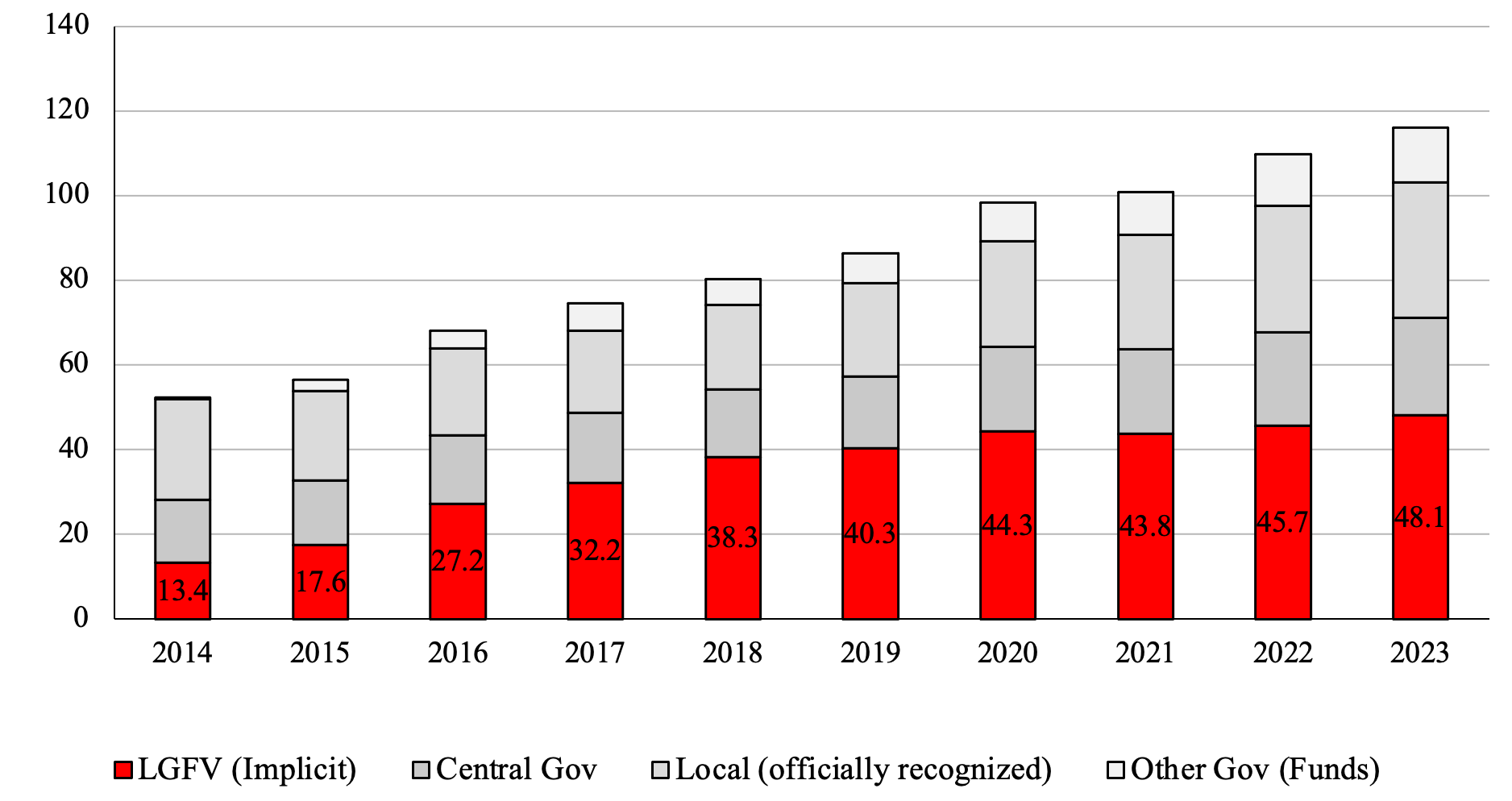

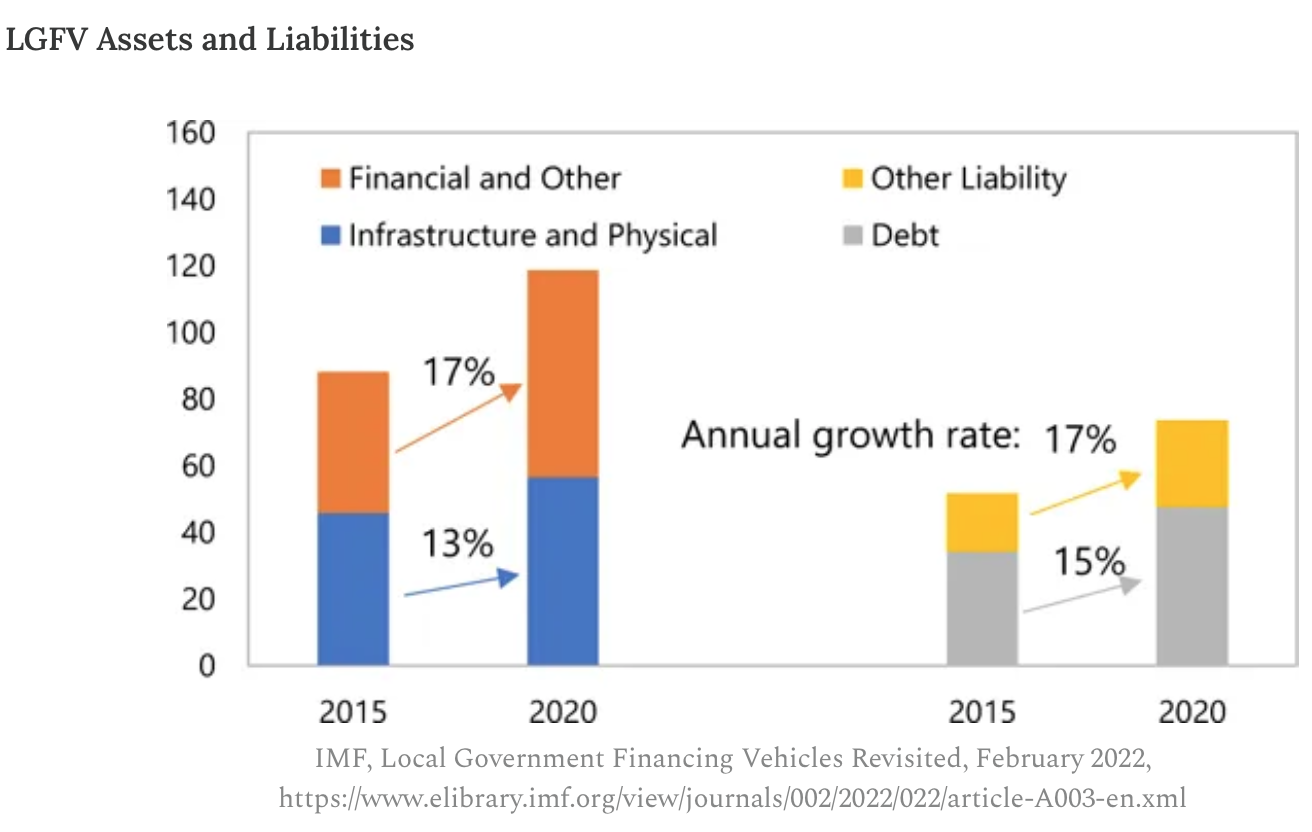

What leaps out of Sine’s account are three main harmful options of the International Monetary Disaster: Hyman Minsky-esque Ponzi finance, leverage on leverage, and complexity. This resemblance turns into extra disconcerting in gentle of the dimensions of the LGFVs: their complete belongings are roughly 120% of Chinese language GDP and their liabilities, 75%.

As disconcerting is that they’ve been rising at a markedly increased price than total financial development, even at their present massive dimension. LGFVs will eat the financial system! Wellie not however they certain try:

Allow us to return to the primary large alarm bell, the truth that the LGFVs are almost all an train in Ponzi financing. For these of you who missed the dialogue through the monetary disaster years, here’s a abstract of economist Hyman Minsky’s idea and terminology, from a 2007 publish:

Hyman Minsky, an economist who studied speculative conduct within the wake of the 1929 crash, noticed that collectors grow to be extra lax about lending requirements throughout occasions of stability. He divided debtors into three sorts: the upstanding type that may pay principal and curiosity; speculative debtors (or “models”), who pays curiosity however should preserve rolling the principal into new loans; and “Ponzi models” which might’t even cowl the curiosity, however preserve issues going by promoting belongings and/or borrowing extra and utilizing the proceeds to pay the preliminary lender. Minsky’s remark:

Over a protracted interval of fine occasions, capitalist economies have a tendency to maneuver to a monetary construction in which there’s a big weight of models engaged in speculative and Ponzi finance.

What occurs? As development continues, central banks grow to be extra involved about inflation and begin to tighten financial coverage,

….speculative models will grow to be Ponzi models and the online price of beforehand Ponzi models will rapidly evaporate. Consequently models with money movement shortfalls will likely be pressured to attempt to make positions by promoting out positions. That’s prone to result in a collapse of asset values.

Once more, take note the important thing function of Ponzi finance being unable to pay curiosity in full, and having to depend on asset gross sales or but extra borrowing to fulfill obligation. From Sine:

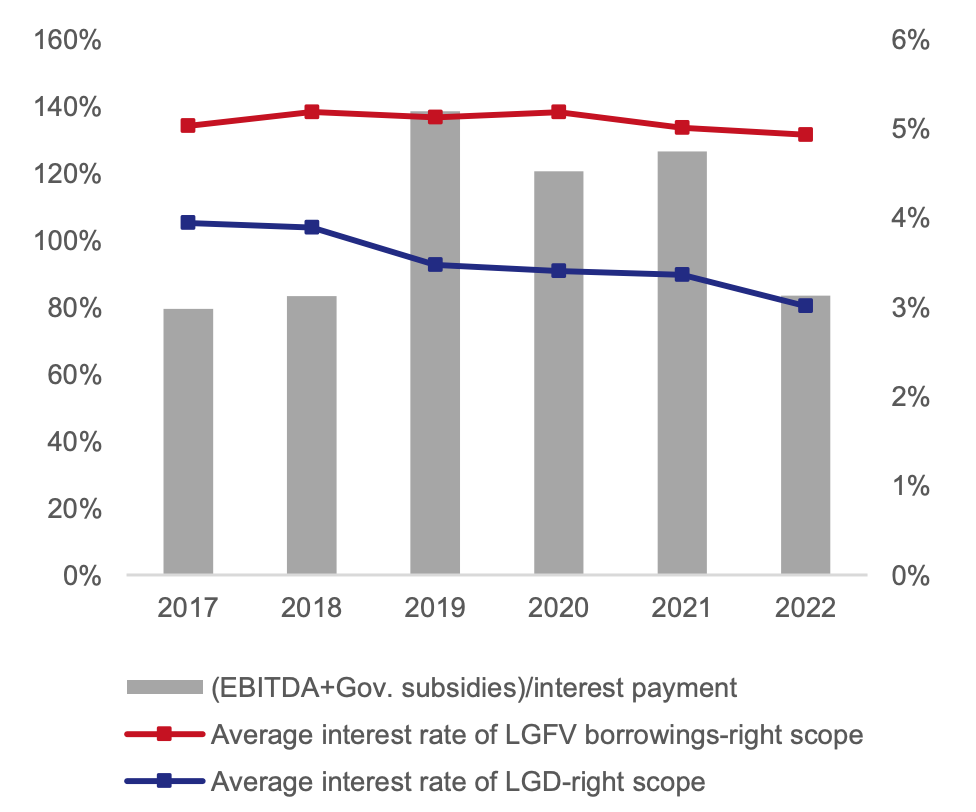

LGFV’s monetary state of affairs is, to place it frankly, very unhealthy. In combination, earnings (earlier than curiosity, taxes, and depreciation, i.e., EBITDA) don’t cowl even their curiosity funds. Together with authorities subsidies solely sometimes pushes the curiosity protection ratio above one. Furthermore, the common borrowing value for LGFVs, 5% or so, far outpaces their 1% return on belongings, posing apparent sustainability issues.

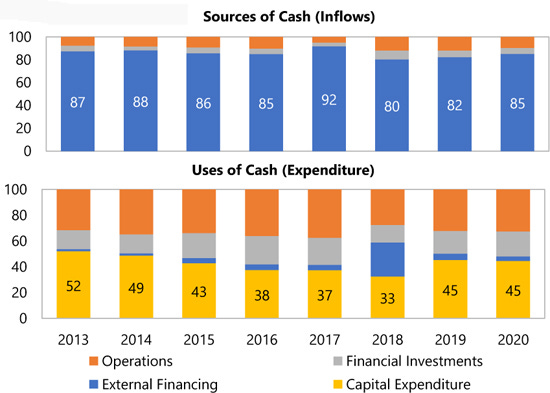

Money flows paint an equally troubling portrait. Yearly 80 to 90 p.c of LGFV spending is funded by new debt. On the entire, LGFVs working inflows don’t come near masking working bills. New debt is routinely added merely to make up the hole and maintain present operations.

As is predictable from the above financials, the inventory of interest-bearing LGFV debt has nearly unceasingly expanded.4 Based on statistics from the IMF, LGFV’s interest-bearing debt has grown from 13% of GDP, or RMB 8.7 trillion, in 2014 to 48% of GDP, or RMB 60.4 trillion, in 2023.

LGFV interest-bearing debt is even bigger than the IMF knowledge above suggests. An unavoidable limitation of assessing LGFVs through backside up knowledge, as the entire above sources do, is that it solely captures the 2-3,000 LGFVs which have issued bonds and revealed related financials. One other 9-10,000 smaller LGFVs have by no means accessed the bond market and are subsequently merely lacking from the information.6 A easy manner of attempting to estimate the remainder of the interest-bearing LGFV debt is to imagine LGFVs observe a Pareto distribution.7 Doing so suggests IMF estimates most likely understate debt by 25%. A extra cheap, if nonetheless possible conservative, estimate of curiosity bearing LGFV debt might be 60% of GDP, or RMB 75 trillion, in 2023.

We’ll skip over the primary a part of Sine’s in-depth historical past of how the LGTVs got here to be. A brief and extremely simplified model is that Chinese language authorities was exceptionally decentralized, which within the post-Mao, pro-market period grew to become an issue because the position of state-owned enterprises and tax revenues shrank. Beijing, to revive its energy, applied a system within the early Nineteen Nineties very a lot akin to Richard Nixon’s income sharing, however extra so: the central authorities collected tax receipts and distributed them to native entities to spend, with the funds typically going by advanced channels. Items and companies taxes account for about 60% of the full, with solely about 6.5% from revenue taxes.

So the native governments acquired across the central authorities income constraints by creating off-budget liabilities. And the LGTV was devised by consultants on the China Improvement Financial institution.

Skipping over the mechanisms the native governments used, the funding got here from banks….which more and more have been newly-created, domestically managed banks. Not onerous to see the place that is going…

To quick ahead to the worldwide monetary disaster, recall that China engaged in very massive scale stimulus whereas the remainder of the world underspent. As Sine notes:

When the middle boldly introduced its RMB 4 trillion stimulus plan to keep off recession, it didn’t intend to fund the stimulus instantly however as a substitute turned to native governments, now replete with financial institution licenses and financing automobile. To at the present time we don’t know precisely how a lot China really spent on its stimulus, although its clear the overwhelming majority got here off-budget through LGFVs….

Predictably, Beijing rapidly misplaced what little management it had of the LGFV growth course of. Not solely was the credit score growth a lot larger than Beijing meant, however LGFVs institutional position expanded and embedded deeper into the sinews of China’s financial system.

The central authorities grew to become sad with how the LGFVs had gotten too large for his or her britches, first operating intrusive audits, then creating lists of shaky-looking LGFVs and urgent banks to not lend to them.

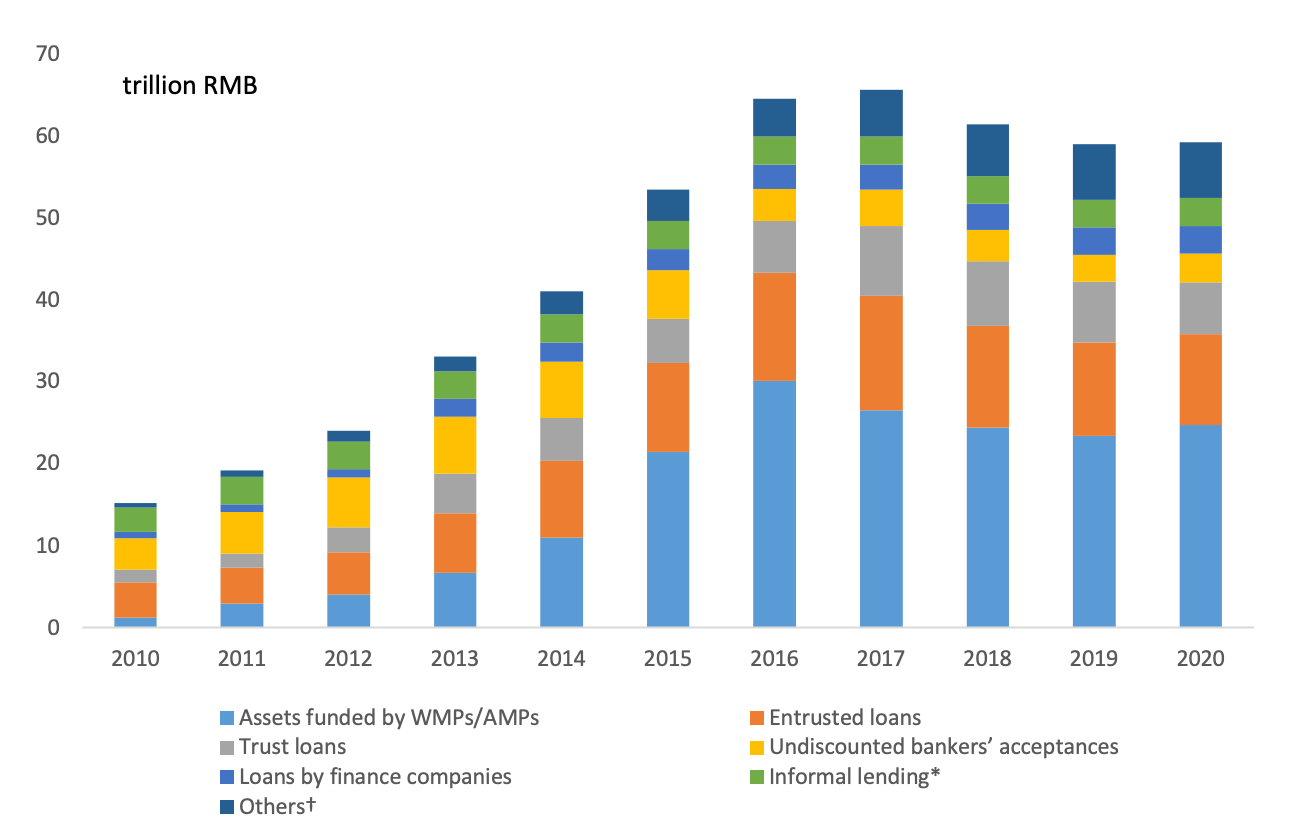

So the LGFVs discovered new cash sources: municipal company bonds, which by 2018 had grow to be 1/3 of all company bonds, and shadow banking.

One other echo of the disaster comes within the half-pregnant standing of the company municipal bonds. Once more from Sine:

…..most “bond consumers most popular LGFV bonds as a result of they provided increased yields than company debt, however have been thought of authorities assured, regardless that they funded initiatives that usually had no capability to repay the debt.”

Keep in mind how Fannie and Freddie debt have been thought of to be authorities assured, till Freddie trying inexperienced on the gills pressured the popularity that they weren’t, legally? After which Treasury put each Fannie and Freddie into conservatorship to include market upset?

Sine factors out that each the company municipal bonds and the shadow banking, which consists primarily of so-called wealth administration merchandise, really do wind up again at banks, in ways in which circumvent laws:

Wealth Administration Merchandise (WMPs), or particular funds set as much as skirt laws on deposit charges, are crucial shadow banking product. WMPs invested closely in municipal company bonds. Chen and He et al calculate that 62% of all MCB proceeds got here from WMPs. And it was banks that created these WMPs, in fact with cash that finally belongs to family depositors/lenders.

There are further flavors of LGFV-financing regulatory arbitrage, comparable to entrusted loans and belief firms.

Allow us to now flip to a second concern, leverage on leverage. That was what arrange the Roaring Twenties growth to finish within the Nice Crash (with trusts of trusts of trusts and CDO-like construction) and the Monetary Disaster (wherein, as we confirmed in ECONNED, CDOs created spectacular leverage). Sine gives an instance:

Zunyi is comparatively unremarkable, a metropolis of middling inhabitants and financial improvement, firmly within the third tier of China’s unofficial metropolis rating system. One latest improvement, nonetheless, has as soon as once more introduced consideration to the town: the more and more pressing Celebration-state effort to cope with LGFV debt. Zunyi Street and Bridge Building (遵义道桥建设) is the star of the present. A snapshot of Zunyi’s company construction provides hints at a few of the poblems.61

Zunyi Street and Bridge, like most LGFVs, is fully-owned by the native, on this case city-level, State Asset Supervision and Administrative Fee (SASAC).62 Established in 1993 and with registered capital of RMB3.6 billion, it’s the second largest of of Zunyi SASAC’s 40+ holdings, a lot of which additionally look like LGFVs. Zunyi Street and Bridge is itself a holding firm with at the very least 10 firms below its umbrella. Many of those corporations are additionally LGFVs. Its largest holdings embody: Zunyi Daoqiao Agricultural Expo Park Co., Ltd., Zunyi Daoqiao Resort Administration Co., Ltd., Zunyi New District Building Funding Group Co., Ltd., and Zheng’an County City and Rural Building Funding Co., Ltd.

Zunyi Street and Bridge Holdings

Zunyi Street and Bridge holding construction, 遵义道桥建设(集团)有限公司, 股权穿透图, through 爱企查 https://aiqicha.baidu.com/company_detail_69261055076241Road and Bridge’s subsidiaries even have subsidiaries. Take for instance, its largest subsidiary: Zunyi Metropolis Baozhou District City Building and Funding (遵义市播州区城市建设投资经营), with registered capital of RMB 1.6 billion. Baozhou City Building itself fully-owns a various array of 10+ companies, starting from a funeral service firm, to a monetary leasing firm seemingly targeted on industrial tools, to a water companies administration firm, in addition to a 49% stake in a property administration firm and a 5% stake in one other diversified LGFV holding firm.

Holdings of Street and Bridge Largest Subsidiary, Baozhou City Building

Zunyi Metropolis Baozhou District City Building Funding Administration (Group) Co. (遵义市播州区城市建设投资经营(集团)有限公司), 股权穿透图, through 爱企查 https://aiqicha.baidu.com/company_detail_62311309937102The financing practices to associate with such an online of holdings have been equally convoluted. One firm could purchase loans or go to the bond market solely to on-lend to its affiliated entities. There are lots of, maybe hundreds, of LGFVs like Zunyi Street and Bridge and just like the one in Dashan County talked about earlier. These conglomerate LGFVs undertake what economist David Daokui Li describes as a “nested layering strategy” to leverage. Corporations at one stage borrow funds, use that borrowed capital to safe further loans on the subsequent subsidiary stage, and amplify debt layer by layer. All of the whereas transferring into increasingly more strains of enterprise.

Evidently, multi-entity enterprises, all lashed along with cross-ownership and debt, are well-nigh unattainable to investigate precisely, not to mention unwind. AIG had the same hen’s nest of exposures in its property and casualty subsidiaries, with cross-ownership, cross-guarantees, and completely different fiscal yr finish dates too. Recall that when AIG was successfully nationalized, the plan was to promote its numerous entities. That by no means occurred. The cross-exposures have been an enormous purpose why.

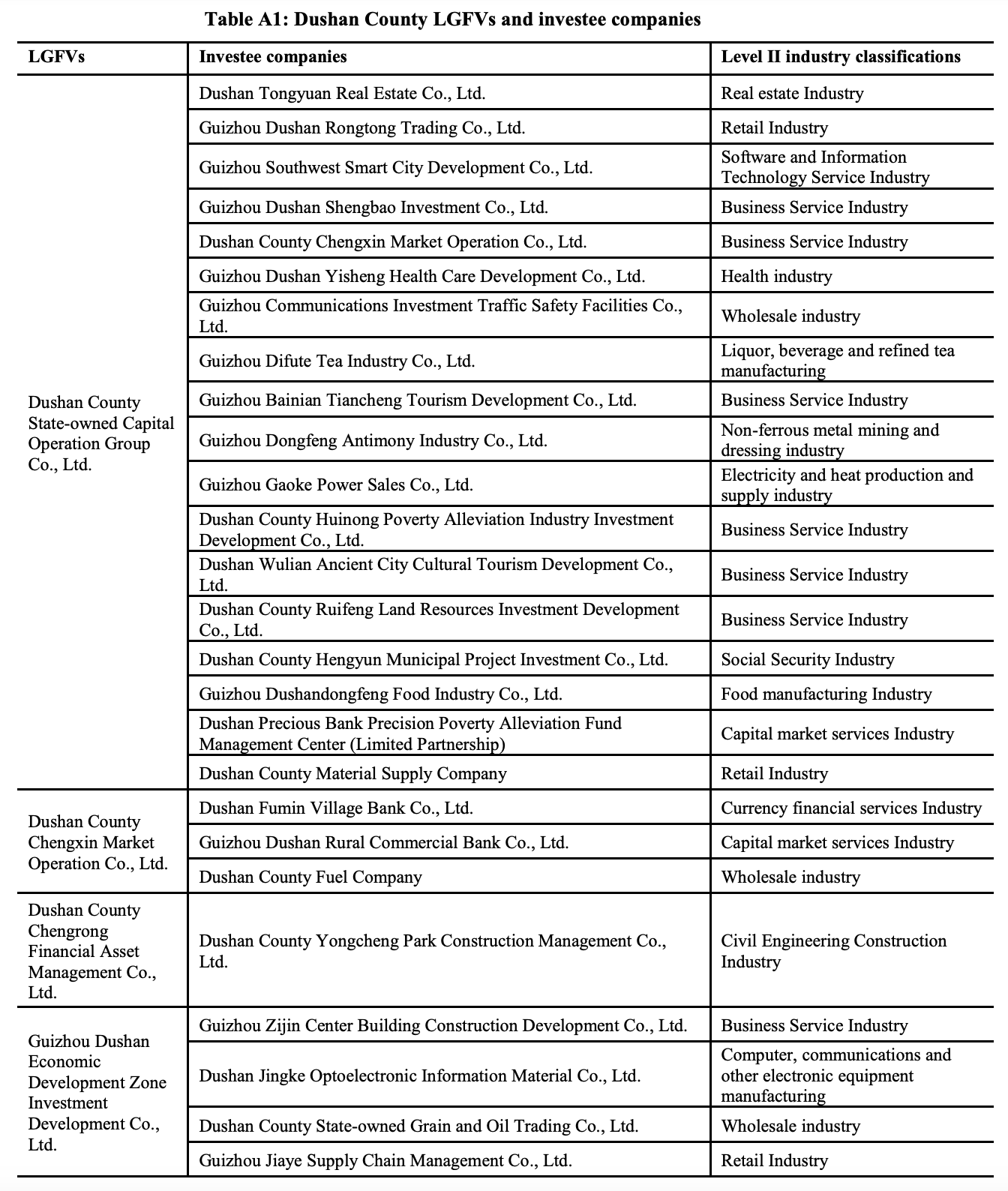

To maintain the publish to a manageable size, and never over-hoist from Sine, we’re giving comparatively quick shrift to the third worrisome signal, complexity. You may simply see the organizational and monetary complexity of the Zunyi Street and Bridge entities. We have now left out the complexity of the companies that the LGFVs get into. An extract from an extended dialogue:

As they expanded, LGFVs moved out properly past their preliminary infrastructural and land improvement remit. One analogy is that LGFVs have grow to be akin to 12 thousand little Huarongs. Huarong, the nation’s largest asset administration firm, was established only a yr after the primary LGFV in 1999. Colloquially known as a “unhealthy financial institution” as a result of it was set as much as take non-performing loans off the Industrial and Industrial Financial institution of China’s stability sheet. Initially an asset restoration agency, Huarong metastasized into an enormous conglomerate with dozens of subsidiaries concerned as many alternative industries. The crazed growth acquired so crazed below former Chairman Lai Xiaomin that the CPC determined to execute him.

See this instance:

Now this complete mess would appear primed for a really unhealthy finish. But many commentators have been predicting unhealthy ends for China’s actual property bubble and its myriad financing mechanisms for a while, and no disaster has occurred.

Nonetheless, one other consequence from an enormous debt overhang is zombification: an excessive amount of cash going to refinancing what would in any other case be unhealthy debt, on the expense of higher makes use of.

Herbert Stein famously mentioned, “That which might’t proceed, gained’t.” However he was silent on when “gained’t” may come to go.

[ad_2]

Source link