[ad_1]

The 12 months 2023 shall be remembered as turbulent for cryptocurrencies, with quite a few essential developments that in the end helped to “clear up” the area to probably make it extra enticing to mainstream buyers. Notably there was the conviction of FTX CEO Sam Bankman-Fried for fraud.

High alternate Binance additionally reached a US$4 billion settlement (£3.1 billion) with the US treasury division over money-laundering prices, which noticed CEO Changpeng “CZ” Zhao agreeing to step down and pay a US$50 million high-quality.

In the meantime, regulators continued cracking down on different operators, however probably misplaced considered one of their key instances towards the trade after a US courtroom dominated that the XRP token, one of many prime ten cryptocurrencies, was not a safety (that means a tradeable monetary asset like shares or bonds).

This implies its creator, Ripple, didn’t break the regulation by promoting it on exchanges. Considered as a check case for almost all of cryptocurrencies, the US Securities Alternate Fee (SEC) is presently interesting.

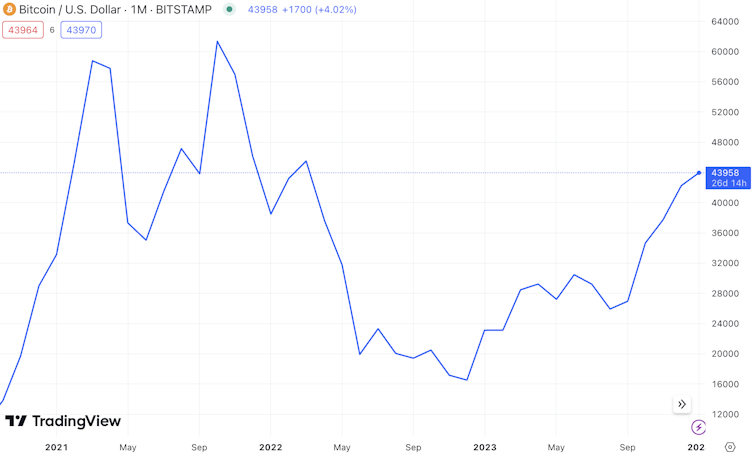

Whereas all this was occurring, the bitcoin value rose away from the lows of late 2022. It began the 12 months at US$16,000 and ended comfortably above the US$40,000 threshold.

So what does 2024 appear to be for this sector and what key occasions are on the horizon?

1. ETFs

The SEC might lastly be about to greenlight a kind of funding automobile often known as an alternate traded fund (ETF) for the for the overall or “spot” bitcoin market. ETFs exist already for every part from oil to the FTSE 100 to even areas and nations. They monitor the underlying asset, creating a simple approach for folks to take a position with out having to purchase the asset instantly.

Till now, the one ETFs permitted for crypto within the US have been for the futures markets. These area of interest markets are involved with the place buyers suppose crypto costs are heading in future.

Bitcoin value 2021-24

Buying and selling View

A spot bitcoin ETF would seemingly encourage mainstream buyers to purchase publicity to this market, whereas probably attracting banks to actively take part too. Bitcoin may very well be supplied by monetary advisors and there would now not be a necessity for buyers to carry the asset itself or face difficulties like crypto exchanges, coin storage and so forth.

There are numerous explanation why many commentators suppose the SEC might now finish its opposition to such an ETF. For one factor, the listing of candidates consists of Blackrock, the most important funding home on this planet, together with varied different main gamers.

Additionally, digital asset group Grayscale gained an essential case towards the SEC in 2023, which had been blocking its try to convert its US$17 billion bitcoin futures ETF, GBTC, right into a spot model. This has compelled the SEC to rethink Grayscale’s software too.

Additional, Hong Kong’s regulatory authority has introduced it’s open to identify bitcoin ETF functions and has laid down pointers allowing a number of varieties. In addition to the fundamental mannequin that we might quickly see within the US, the place buyers would purchase into bitcoin ETFs with {dollars}, Hong Kong is open to a second selection often known as “in-kind”.

This might make it attainable to transform shares in a bitcoin ETF into bitcoin and vice versa, permitting extra flexibility and probably attracting extra institutional buyers into the area.

2. Rates of interest

Jerome Powell, chair of US central financial institution the Federal Reserve, has indicated that rates of interest might have peaked, and that the Fed is more likely to minimize them throughout 2024. Equally within the UK, main mortgage lender Halifax has minimize its lending charge in expectation of a Financial institution of England charge minimize.

If rates of interest are minimize and even stabilise in 2024, it may make bitcoin (and different digital belongings) extra enticing to buyers, since its restricted provide makes it a hedge towards conventional currencies dropping worth over time.

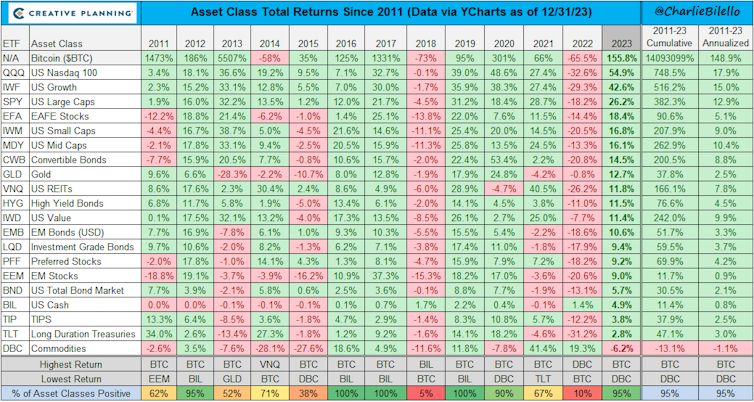

Extra typically, charge cuts immediate buyers to search for increased funding returns, and cryptocurrencies have delivered right here too.

Asset class returns since 2011

Charlie Bilello

As well as, the US and different economies might enter a recession within the later half of 2024 as a result of lagged results of the rate of interest hikes.

Equally, we noticed quite a few financial institution failures in 2023, predominantly within the US. Within the occasion of a recession or extra financial institution issues, governments could also be compelled to offer stimulus packages and print more cash. This might additional devalue currencies and make bitcoin nonetheless extra enticing.

3. The halving

An enormous occasion for bitcoin in 2024 is the so-called “halving”. Bitcoin runs on an internet ledger often known as a blockchain, during which entries are validated by “miners” utilizing arrays of computer systems to unravel complicated mathematical puzzles. Miners are paid in bitcoin for finishing a set of transactions often known as a block, and the protocol stipulates that their reward per block halves each 210,000 “blocks” (roughly each 4 years).

The reward started at 50 bitcoin in 2009 and is anticipated to fall from 6.25 bitcoin to three.125 bitcoin across the center of April 2024.

This lower entails fewer bitcoin offered available on the market, which tightens provide and should squeeze out the least environment friendly miners, considerably decreasing the pc energy utilized by the community. The three earlier halvings have prompted dramatic bull runs, whereas additionally driving up the costs of digital belongings extra typically as buyers take extra dangers within the area.

Halving results

Buying and selling View

4. Blockchain developments

The bitcoin community noticed quite a few technological developments in 2023. This has included enabling a brand new and a singular type of NFTs (non-fungible tokens) often known as ordinals, and likewise a brand new commonplace known as BRC-20 that makes it attainable to create new cryptocurrencies on the community. Till now, NFTs and new cryptocurrencies have principally been issued on different blockchains resembling ethereum.

We’re additionally seeing rising adoption of the Lightning community, a layer above the bitcoin blockchain that allows a lot sooner transactions. All these modifications are leading to elevated demand for bitcoin, which in flip might result in increased costs.

In sum, there’s a powerful case for being bullish about bitcoin’s value within the 12 months forward. Commentators’ predictions vary from US$60,000 to US$500,000 by 12 months finish. Our personal perception is that although the street could also be bumpy, 2024 may properly see elevated adoption of cryptocurrencies, which can drive costs past the present US$40,000 mark.

[ad_2]

Source link