[ad_1]

Within the 1960 western The Magnificent Seven, a gaggle of seven gunfighters defend a village from bandits. Solely three survive to experience out of city on the finish of the film. The percentages look a lot better for the seven tech corporations not too long ago dubbed the magnificent seven after dominating US inventory markets in 2023. However there are issues that would ambush a few of these corporations in 2024.

Apple, Alphabet, Microsoft, Amazon, Meta, Tesla and Nvidia have pushed a rally in US shares in 2023. They now make up practically a 3rd of the S&P 500 measure of the most important listed US corporations, which has risen greater than 20% since January. These tech shares had offered shareholders with a whopping 71% return by mid-November whereas the opposite 493 names added simply 6%.

This spectacular efficiency led Financial institution of America analyst Michael Hartnett to call these corporations the magnificent seven earlier this 12 months. Goldman Sachs quickly adopted, calling their large outperformance the “defining characteristic” of the fairness market in 2023.

However as dramatic as this efficiency has been – and though they’re all basically tech corporations – don’t make the error of pondering they’re all the identical. In actual fact, the outlook for the magnificent seven subsequent 12 months is combined, notably in gentle of anticipated adjustments of their core markets.

Rising competitors within the EV market

Let’s begin with the unhealthy information first. Electrical automobile (EV) producer Tesla Motors will proceed to lose market share in 2024. Whereas chief government Elon Musk has been coping with promoting issues on X (previously Twitter), considered one of his different companies, over the primary three quarters of this 12 months, Tesla has seen its US market dominance shrink from 62% to simply over 50% of the market. Each BMW Group and Mercedes-Benz Automobiles have expanded their footprints.

And over the following few years, the rising international heft of Chinese language producers appears to be like exhausting to beat. Chinese language EV gamers comparable to BYD, Nio, Wuling and Xpeng produced virtually 60% of the world’s EVs in 2022 – and so they have been doing so in a really inexpensive method. Within the first half of 2023, the common price of an EV in China was US$33,000 (£26,040), greater than half the US$70,700 (£55,800) folks pay for EVs in Europe and the US$72,000 (£56,800) paid within the US.

US president Joe Biden has proposed strict new automobile air pollution controls that can require virtually two-thirds of latest automobiles bought within the US to be electrical by 2032. However the price of EVs might want to come down if they’re to attain mass market attraction.

canadianPhotographer56/Shutterstock

Sunny outlook for cloud computing

Magnificent seven members Amazon, Microsoft and Alphabet make up two-thirds of the cloud computing market, which can proceed to develop in 2024, though maybe not fairly as a lot as up to now.

Nonetheless, the marketplace for cloud infrastructure providers is predicted to broaden from US$122 billion in 2023 to US$446 billion by 2032. Particularly, considerations in regards to the macroeconomic surroundings have seen some prospects deal with utilizing the cloud extra to cut back prices lately, though this has but to have any significant affect on revenues.

And for Amazon particularly, there are some niggling questions round its outlook. Though its cloud enterprise stays stable, its unique e-commerce enterprise has seen rising competitors not too long ago, notably from rival retail big Walmart, which is consuming into its enterprise within the US.

That is one cause why holding Amazon shares offered an annual return over the previous two years of -16.7%, as of early December, based on my calculations.

Unstoppable AI

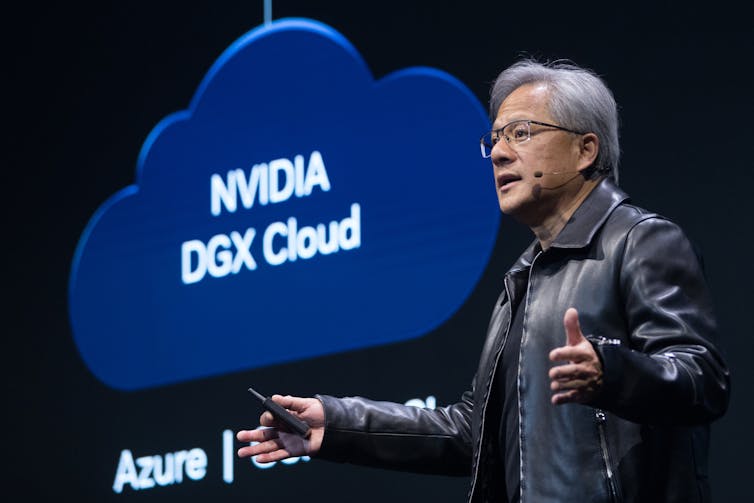

Additionally linked to the cloud computing business, California-based chip maker Nvidia Company has been the runaway success of the magnificent seven this 12 months. That is all because of its dominance in processing AI workloads on the cloud. Nearly all of cloud gamers use Nvidia graphics processing models (GPUs).

However whereas its two-year return of 43.3% is essentially the most spectacular of the seven tech corporations, there are rivals on the horizon that would nibble away at some market share.

Nvidia’s nearest rival AMD drew consideration with its newest chip providing in 2023 – it’s betting the market will probably be price US$400 billion by 2027. Quite a few different start-ups are additionally growing chips for area of interest AI fields.

Can Nvidia preserve its dominance? If it does, its earnings will skyrocket

alongside the expansion of AI. However even when it loses some market share, the AI market will growth for years.

jamesonwu1972/Shutterstock

The outliers

For these preserving observe, that simply leaves two closing members of the magnificent seven.

Apple Inc – the world’s largest firm by market capitalisation – constantly delivers stable returns: 16.2% over the previous two years by my calculations. On the different finish of the dimensions, social media firm Meta (proprietor of Fb, Instagram, Threads and WhatsApp) is the one one of many group to have proven an basically flat inventory market efficiency over the previous two years.

Though Meta’s revenues and earnings have constantly crushed expectations this 12 months, the specter of anti-trust laws within the US and Europe hangs over the corporate, as does an promoting market that’s bottoming out. Each of those points may hurt Meta’s income outlook subsequent 12 months.

So, the magnificent seven have all survived to experience out of city on the finish of 2023, however it’s as clear as a tumbleweed rolling down a abandoned fundamental road that not all of them are in for a leisurely horseback experience by way of 2024. Saddle up, companions!

[ad_2]

Source link