[ad_1]

Greater than half (56%) of chief economists count on the worldwide financial system to weaken in 2024, with seven in 10 saying tempo of geoeconomic fragmentation will speed up, in keeping with the most recent Chief Economists Outlook.

Two-thirds mentioned industrial insurance policies will create new development hotspots, however majority warns of rising fiscal strains and divergence between higher- and lower-income economies.

Generative AI is seen to extend productiveness and innovation, with specialists notably extra optimistic about AI-enabled advantages for high-income economies.

International financial prospects stay subdued and fraught with uncertainty, in keeping with the most recent Chief Economists Outlook launched at present, as the worldwide financial system continues to grapple with headwinds from tight monetary circumstances, geopolitical rifts and fast advances in generative synthetic intelligence (AI).

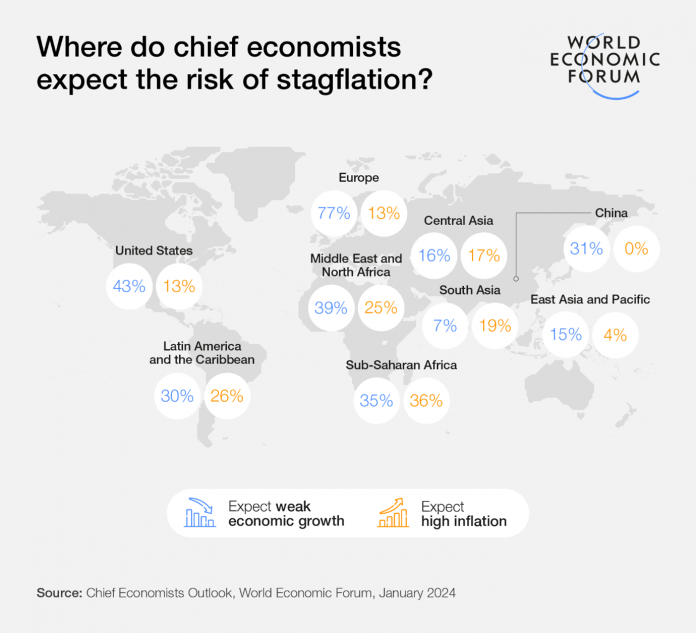

Greater than half of chief economists (56%) count on the worldwide financial system to weaken this 12 months, whereas 43% foresee unchanged or stronger circumstances. A robust majority additionally consider labour markets (77%) and monetary circumstances (70%) will loosen over the approaching 12 months. Though the expectations for top inflation have been pared again in all areas, regional development outlooks differ broadly and no area is slated for very robust development in 2024.

“The newest Chief Economists Outlook highlights the precarious nature of the present financial atmosphere,” mentioned Saadia Zahidi, Managing Director, World Financial Discussion board. “Amid accelerating divergence, the resilience of the worldwide financial system will proceed to be examined within the 12 months forward. Although international inflation is easing, development is stalling, monetary circumstances stay tight, international tensions are deepening and inequalities are rising – highlighting the pressing want for international cooperation to construct momentum for sustainable, inclusive financial development.”

Regional variations

The outlook for South Asia and East Asia and Pacific stays optimistic and broadly unchanged in comparison with the final survey, with a powerful majority (93% and 86% respectively) anticipating not less than reasonable development in 2024. China is an exception, with a smaller majority (69%) anticipating reasonable development as weak consumption, decrease industrial manufacturing and property market issues weigh on the prospects of a stronger rebound.

In Europe, the outlook has weakened considerably because the September 2023 survey, with the share of respondents anticipating weak or very weak development nearly doubling to 77%. In the US and the Center East and North Africa, the outlook is weaker too, with about six in 10 respondents foreseeing reasonable or stronger development this 12 months (down from 78% and 79% respectively). There’s a notable uptick in development expectations for Latin America and the Caribbean, sub-Saharan Africa and Central Asia, though the views stay for broadly reasonable development.

Geopolitical rifts compound uncertainty

About seven in 10 chief economists count on the tempo of geoeconomic fragmentation to speed up this 12 months, with a majority saying geopolitics will stoke volatility within the international financial system (87%) and inventory markets (80%), improve localization (86%), strengthen geoeconomic blocs (80%) and widen the North-South divide (57%) within the subsequent three years.

As governments more and more experiment with industrial coverage instruments, specialists are almost unanimous in anticipating these insurance policies to stay largely uncoordinated between nations. Whereas two-thirds of chief economists count on industrial insurance policies to allow the emergence of recent financial development hotspots and very important new industries, a majority additionally warn of rising fiscal strains (79%) and divergence between higher- and lower-income economies (66%).

AI takes the highlight

Chief economists count on AI-enabled advantages to differ broadly throughout earnings teams, with notably extra optimistic views in regards to the results in high-income economies. A robust majority mentioned generative AI will improve effectivity of output manufacturing (79%) and innovation (74%) in high-income economies this 12 months. Trying on the subsequent 5 years, 94% count on these productiveness advantages to turn out to be economically important in high-income economies, in comparison with solely 53% for low-income economies.

Virtually three-quarters (73%) don’t foresee net-positive impression on employment in low-income economies and 47% mentioned the identical for high-income economies. The views are considerably extra divided on the chance of generative AI to extend requirements of residing and to result in a decline in belief, with each being barely extra possible in high-income markets.

[ad_2]

Source link