[ad_1]

The SEC has been busy, assembly with the entire potential issuers of spot Bitcoin ETFs with lively functions in December. These conferences have resulted within the common adoption of a money creation methodology by these issuers as a substitute of “in sort” transfers, as is typical for different ETFs. A lot has been stated about this alteration, starting from the absurd to the intense. The TLDR, nevertheless, is the general influence shall be minimal to buyers, comparatively significant to the issuers and it displays poorly on the SEC total.

With the intention to present context, you will need to describe the fundamental construction of Alternate Traded Funds. ETF issuers all have interaction with a bunch of Licensed Individuals (APs) which have the flexibility to trade both a predefined quantity of the funds property (shares, bonds, commodities, and many others) or an outlined amount of money or a mix of each, for a set quantity of ETF shares for a predetermined payment. On this case, had been “in sort” creation to be allowed, a reasonably typical creation unit would have been 100 Bitcoin in trade for 100,000 ETF shares. With money creation, nevertheless, the Issuer shall be required to publish the money quantity, in actual time as the worth of Bitcoin adjustments, to accumulate, on this instance, 100 Bitcoin. (In addition they should publish the money quantity that 100,000 ETF shares may be redeemed for in actual time.) Subsequently the issuer is answerable for buying that 100 Bitcoin for the fund to be in compliance with its covenants or promoting the 100 Bitcoin within the case of a redemption.

This mechanism holds for all Alternate Traded Funds, and, as may be seen, signifies that the claims that money creation means the fund wont be backed 100% by Bitcoin holding is flawed. There could possibly be a really brief delay, after creation, the place the Issuer has but to purchase the Bitcoin they should purchase, however the longer that delay, the extra danger the issuer could be taking. If they should pay greater than the quoted value, the Fund may have a damaging money steadiness, which might decrease the Internet Asset Worth of the fund. This may, after all influence its efficiency, which, contemplating what number of issuers are competing, would probably hurt the issuers capability to develop property. If, however, the issuer is ready to purchase the Bitcoin for lower than the money deposited by the APs, then the fund would have a optimistic money steadiness, which might enhance fund efficiency.

One might surmise, subsequently, that issuers may have an incentive to cite the money value nicely above the precise buying and selling value of Bitcoin (and the redemption value decrease for a similar cause). The issue with that, is the broader the unfold between creation and redemption money quantities, the broader the unfold that APs would probably quote available in the market to purchase and promote the ETF shares themselves. Most ETFs commerce at very tight spreads, however this mechanism might nicely imply that a number of the Bitcoin ETF points have wider spreads than others and total wider spreads than they might have had with “in sort” creation.

Thus, the issuers should steadiness the objective of quoting a decent unfold between creation and redemption money quantities with their capability to commerce at or higher than the quoted quantities. This requires, nevertheless, entry to stylish expertise to attain. For instance of why that is true, think about the distinction between quoting for 100 Bitcoin primarily based on the liquidity on Coinbase alone, vis a vis a technique that makes use of 4 exchanges which are regulated within the U.S. (Coinbase, Kraken, Bitstamp and Paxos). This instance used CoinRoutes Price Calculator (obtainable by API) which exhibits each single trade or any customized group of exchanges value to commerce primarily based on full order e-book information held in reminiscence.

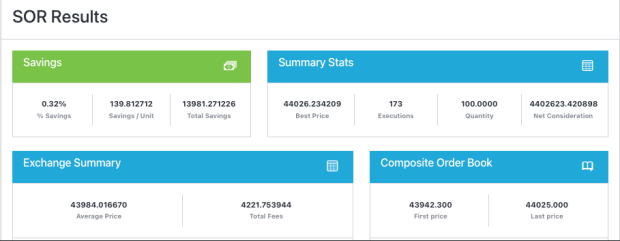

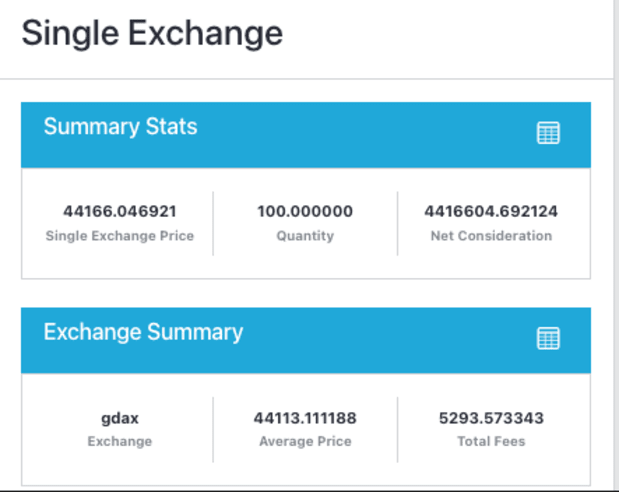

In this instance, we see {that a} whole buy value on Coinbase alone would have been $4,416,604.69 however the value to purchase throughout these 4 exchanges would have been $4,402,623.42, which is $13,981.27 dearer. That equates to 0.32% extra expense to purchase the identical 100,000 shares on this instance. This instance additionally exhibits the expertise hurdle confronted by the issuers, because the calculation required traversing 206 particular person market/value stage combos. Most conventional monetary programs don’t have to look past a handful of value ranges because the fragmentation in Bitcoin is way bigger.

It’s value noting that it’s unlikely the foremost issuers will choose to commerce on a single trade, however it’s probably that some will accomplish that or choose to commerce over-the-counter with market makers that can cost them an extra unfold. Some will choose to make use of algorithmic buying and selling suppliers corresponding to CoinRoutes or our opponents, that are able to buying and selling at lower than the quoted unfold on common. No matter they select, we don’t count on all of the issuers to do the identical factor, that means there shall be doubtlessly vital variation within the pricing and prices between issuers.

These with entry to superior buying and selling expertise will have the ability to provide tighter spreads and superior efficiency.

So, contemplating all of this problem that shall be borne by the issuers, why did the SEC successfully power the usage of Money Creation/Redemption. The reply, sadly, is easy: APs, by rule are dealer sellers regulated by the SEC and an SRO corresponding to FINRA. Up to now, nevertheless, the SEC has not authorized regulated dealer sellers to commerce spot Bitcoin instantly, which they might have wanted to do if the method was “in sort”. This reasoning is a much more easy rationalization than numerous conspiracy theories I’ve heard, that don’t need to be repeated.

In conclusion, the spot ETFs shall be a significant step ahead for the Bitcoin trade, however the satan is within the particulars. Traders ought to analysis the mechanisms every issuer chooses to cite and commerce the creation and redemption course of with a view to predict which of them may carry out greatest. There are different considerations, together with custodial processes and costs, however ignoring how they plan to commerce could possibly be a expensive choice.

It is a visitor publish by David Weisberger. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

[ad_2]

Source link